Hello there!

Hope 2024 has gotten off to a good start for you. It certainly seems to have for the Indian EV ecosystem from a fund-raising perspective, if you go by the recent flurry of deals announced in this space.

This month, we turn our focus to key developments in the Global Battery market in 2023, as summarized in the Volta Foundation’s newly launched Annual Battery Report, an excellent overview of the latest battery research, policy and business landscape. This is the first of a two-part series based on this report, and we look forward to hearing your views and suggestions on which of these topics we could further deep dive into?

Batteries – the Key to the Energy Transition?

Ostara’s Sep 2023 newsletter highlighted the crucial role of batteries in the energy transition. Here is a quick recap:

Record Investments: In 2023, Global renewable energy investments surged to $1.77 trillion, a 17% increase from the previous year.

Historical Evolution: Battery technology has evolved over two centuries, from Volta's cell to modern lithium-ion batteries, becoming indispensable for the energy transition.

Lithium-ion Dominance: The global lithium-ion battery market is projected to grow from $56.8 billion in 2023 to $187.1 billion in 2032, at a CAGR of 14.2%.

Addressing Intermittency: Batteries, especially lithium-ion, help mitigate renewable energy intermittency, enhancing grid stability and reducing reliance on continuous base-load power sources.

The Wired Network: Navigating the Battery Value Chain

The global battery value chain refers to the interconnected network of processes, technologies, and industries involved in the production, distribution, and use of batteries worldwide. Batteries lead to significant economic potential across industries like the transport and the power sector.

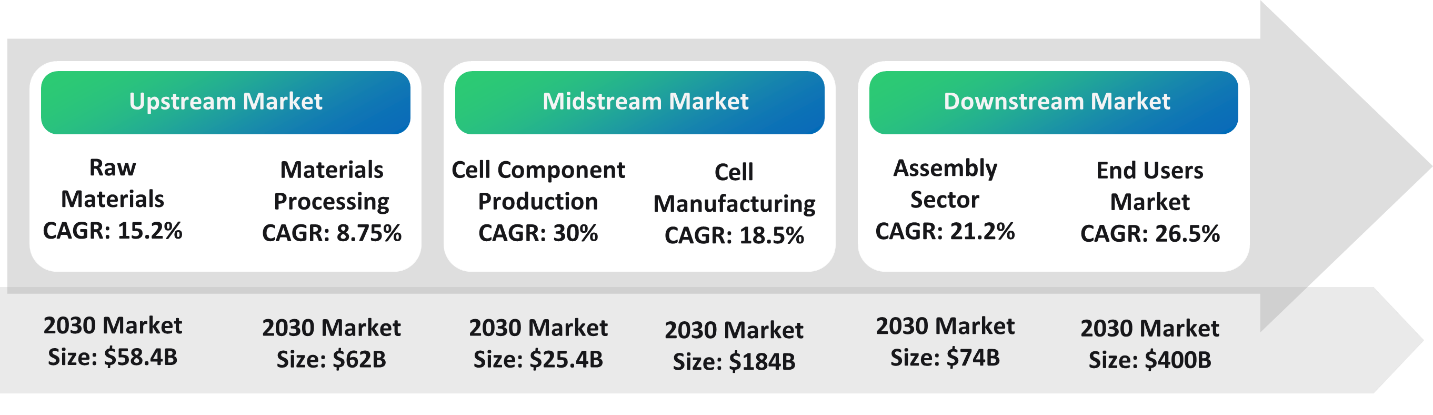

The above components of the battery value chain can be categorized into upstream, midstream and downstream. Industry restructuring is blurring traditional sector boundaries, impacting market dynamics and competitive strategies. Robust growth is projected across all industry segments by 2030, as depicted below:

Charged Up: Funding Sparks in the Battery Market

In 2023, public battery companies faced trading downturns due to macroeconomic factors and higher interest rates impacting hard tech firms, resulting in adverse effects on companies in each category:

Incumbent Battery Firms: Incumbents like LG Energy Solution experienced lower-than-expected demand from traditional EV manufacturers.

Lithium Companies: Companies like Albemarle witnessed a significant drop in lithium carbonate equivalent (LCE) spot prices.

Battery Startups: Companies like Freyr encountered challenges related to high capital expenditures.

EV Startups: Rivian faced lower-than-forecasted demand and extended timelines to scale their operations.

EV Charging Companies: Companies like EVgo struggled with low utilization rates, unexpected maintenance issues, and subpar user experiences.

Despite these challenges, the battery sector saw major funding developments, albeit against a difficult equity funding backdrop:

Public sector offerings by battery startups

Notable M&A transactions in the Global Battery Market

Private Investment into batteries:

While global climate tech venture funding dropped 40% in the first half of 2023, the year also marked the announcement of various private credit funds that are expected to cater to the Capex requirements of the industry. Here are the some of the key deals in private equity and credit funding in 2023:

There are estimated to be $121B of private climate assets under management and the investors can be categorized thus:

Early-stage VC like Earthshot Ventures, Anzu Partners, and Prelude Ventures

Corporate VC like bp ventures, Shell Ventures, and TDK Ventures

Late-stage VC / Growth equity like Breakthrough Energy, and Decarbonization Partners

Private equity like Ara Partners, Apollo Clean Energy Transition, and Cleanhill Partners

Infrastructure Funds like KKR, Zouk, and Vision Ridge Partners

Sovereign Wealth Fund / Pension Funds like CPP investments, Kuwait Investment Authority, and GIC

Powering Progress: The Declining Cost of Battery Cells

Follow Ostara Advisors to stay updated with the latest trends related to Electric Vehicles, Innovation and Sustainability from India and around the globe.